All Episodes

Displaying 211 - 240 of 305 in total

#95 Mike Bell on American Banker's Article The Polarizing Question of Credit Union's Buying Banks

Mike Bell of Honigman LLC was recently interviewed by Ken McCarthy of American Banker: The Polarizing Question of Credit Unions Buying Banks.Bell is the GURU of bank ...

#94 - Select From the Archive - Practical Advice on Dealing with NCUA on Liquidity

With Liquidity becoming a bigger priority every day we are today's episode is a from the recent archive and discusses how to deal with NCUA on liquidity issues, practi...

#93: You Can't Regulate Stupidity & Silicon Valley & Signature Banks were STUPID!

Link to Whitehouse "fact" sheet:https://www.whitehouse.gov/briefing-room/statements-releases/2023/03/30/fact-sheet-president-biden-urges-regulators-to-reverse-trump-ad...

#92 SVB Regulators Bail Out Just 10 Depositors at Cost of $13.3 Billion?

Banking Committee Hearings reveal many things about the ramifications of the failure of SVB Bank.New regulations, new guidance, new costs and much more. All that bein...

#88 NCUA's Field Of Membership Proposal With Rick Mumm

The NCUA Board recently approved a proposal to update their Field of Membership Rule. Its nine potential changes aim to enhance consumer access to safe, fair, and affo...

#90 SVB: Yellen Flip Flop - Inherent Safety of Credit Unions - & Electronically Panic!

50 years ago the Major Baseball began the Designated Hitter. What does this have to do with Credit Unions? Check it out as I discuss my quotes in Foxbusiness news arti...

#89 Implied Uninsured Guarantees, Fed Rate Increases, FHLB Record Level of Borrowing & More

Another exciting news day:Yellin Implies a deposit guaranteeFHLB Record BorrowingALLL Increasingand much more on today's news summary.

#88 Treasury Secretary Janet Yellin Faces Tough Questions on Treatment of Too Big To Fail Banks

Could the failure of SVB and Signature Result in an NCUSIF Insurance Premium? Maybe.In this episode we mostly hear word for word from Secretary Janet Yellin and Senat...

What We Know About Signature Bank's Failure Plus Barney Frank on Insuring Business Deposits

More information is trickling out about how and why Signature Bank failed.Also Barney Frank is again touting the need for insuring business accounts. I provide my tak...

#86 NCUA's March Board Meeting and Today's SVB News

THis episode discusses the statements made by NCUA about the safety and soundness of credit unions, board actions, and Silicon Valley Bank new. NCUA issues this Board...

#85 Is It Time to Insure All Deposits? More Silicon Valley Bank Fall Out

Is It Time to Insure all Bank Deposits. As Wharton Business School Professor stated, It is time to reckon with that.I discuss this and more in today's episode of With...

#84 Silicon Valley Bank Blame Game & The Federal Reserve's New Program

The SVB Blame Game is on - but their is enough blame to go around.Link to Feds loan program:https://www.federalreserve.gov/monetarypolicy/bank-term-funding-program.htm...

#81 How Will NCUA Respond to the Silicon Valley Bank Collapse?

How Will NCUA Respond to Silicon Valley Bank Closure?Hey everyone. This is Mark Treichel with another episode of With Flying Colors. I am recording this on March 12th....

#82 Fed, FDIC & Treasury Act to Protect Depositors - Is This a Good Bailout?

Joint Statement by the Department of the Treasury, Federal Reserve, and FDICThe following statement was released by Secretary of the Treasury Janet L. Yellen, Federal ...

#80 The Failure of Silicon Valley Bank & What Happens Next

FDIC Closed Silicon Valley Bank on Friday. How will the play out? Will there be contagion? Should this be Caveat Emptor or should there be a bailout? Who are what ...

#83 Catching Up With Geoff Bacino

Today's guest will paint us a picture of great value with flying colors!In this episode, Mark Treichel speaks with Geoff Bacino, a former NCUA Board Member, about the ...

#79 Is NCUA Planning for Separate Consumer Compliance Exams?

During his GAC Speech, NCUA Chairman Todd Harper said:"... It doesn't seem fair that credit union members have less protection than bank customers...and it's why we ar...

#78 Short Take on Liquidity Risk - Why it Is NCUA's #2 Concern

Liquidity RiskHigher interest rates have caused a slowdown in prepayments for some loans and investment holdings, which has resulted in reduced cashflows. Large increa...

#77 CUNA GAC Short Take: Interest Rate Risk Why It Is Priority 1

Interest Rate RiskInterest rates rose significantly across the yield curve during 2022, elevating interest rate risk (IRR) and the related exposure to earnings and cap...

#75: Part 2 - NCUA's Supervisory Priorities 2023 - Fraud, Cyber, Consumer Protection & More

Fraud Prevention, Cyber-Security and Consumer Protection - are covered today relative to NCUA's Supervisory Priority Letter. We also discuss succession planning, tran...

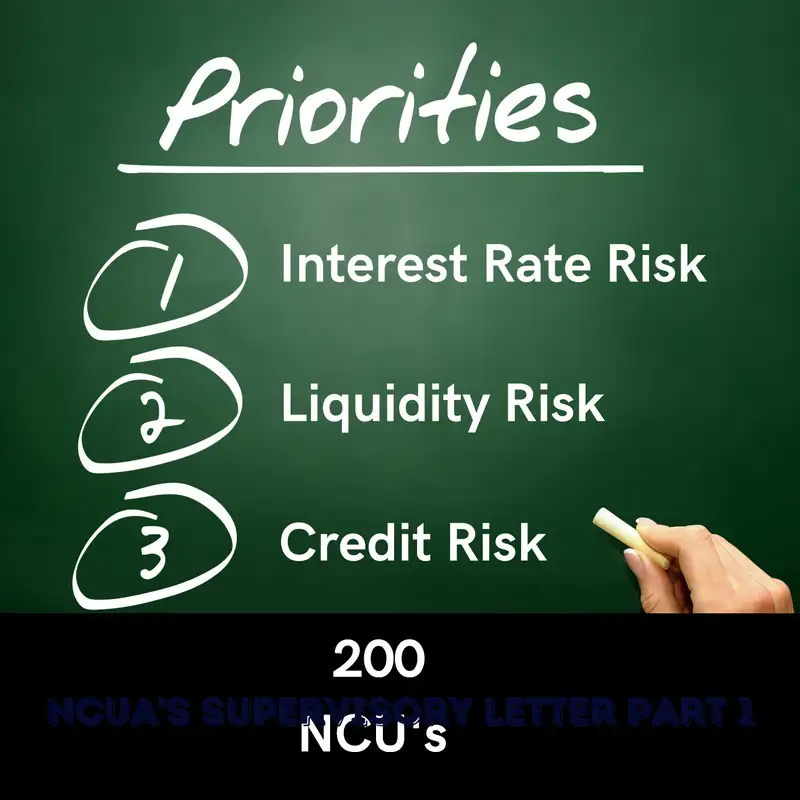

#74: NCUA's Supervisory Priorities 2023 - Part 1: IRR, Liquidity & Credit Risk

NCUA's 2023 Priority Letter was recently released. In this episode I discuss the top 3: Interest Rate Risk, Liquidity Risk, and Credit Risk with two members of my te...

#73 NCUA IS OK With 1,000 Percent Increase in CAMEL Code 4s

NCUA just approved its Annual Performance Plan. It included a goal of achieving CAMELS code 4s and 5s of less than 2 percent of assets. This would allow an a ten fol...

#72 Never Let A Good Crisis Go To Waste or Why NCUA Should Have Approved 21%

Winston Churchill said never let a good crisis go to waste. This is why NCUA should have approved a rule allowing Federal Credit Unions to grant loans up to 21%.Per N...

#71: What's Not On NCUA's Supervisory Priority Letter & Why It Matters

𝙒𝙝𝙖𝙩 𝙞𝙨 𝙉𝙊𝙏 𝙤𝙣 𝙉𝘾𝙐𝘼'𝙨 𝙎𝙪𝙥𝙚𝙧𝙫𝙞𝙨𝙤𝙧𝙮 𝙋𝙧𝙞𝙤𝙧𝙞𝙩𝙞𝙚𝙨 𝙛𝙤𝙧 𝟮𝟬𝟮𝟯?I write and speak often about NCUA's Supervisory Priorities which come out at this time every year.Last year NCUA...

# 70 Dan Berger & NAFCU's 2023 Priorities

Mark Treichel welcomes Dan Berger, the CEO of the National Association of Federally-Insured Credit Unions, to discuss NAFCU's 2023 advocacy priorities. They touch on t...

#69 A CUSO That Helps Members with Health Care

Sam Brownell of CUCollaborate made this post on LinkedIn last week:I am thrilled to announce that CUCollaborate is incubating its first CUSO to pursue "the best idea I...

#68 NCUA's Meaning of Agreed Upon Corrective Action

NCUA's Examination reports all state that the exam report documents our conclusions and agreed upon corrective actions.So what does agreed upon mean?It means you need ...

67 A Look Back & A Look Ahead

A look back at 2022 in Credit Unions, NCUA, and With Flying Colors - and a Look ahead at the opportunities and challenges in 2023.NCUA will soon act on Field of Member...

Credit Union Mergers With NAFCU Author Mike Lussier

Credit union mergers are essential to everyone in a business, from the board of directors, the staff, down to the members themselves. When a merger happens, every aspe...