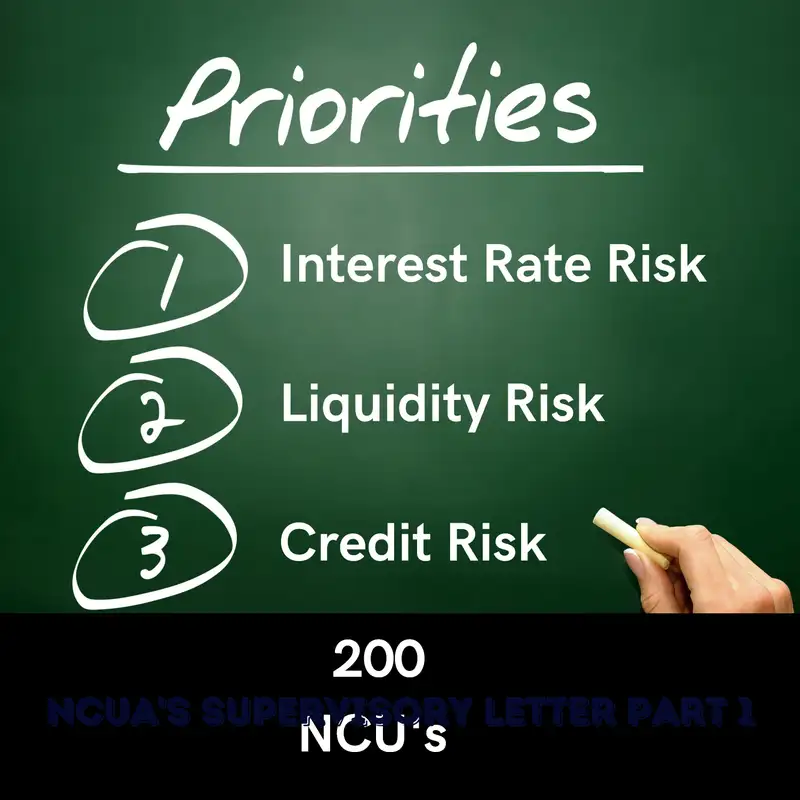

NCUA's 2023 Priority Letter was recently released. In this episode I discuss the top 3: Interest Rate Risk, Liquidity Risk, and Credit Risk with two members of my team: Todd Miller and Steve Farrar.Per NCUA:Supervisory Priorities for 2023Interest Rate RiskInterest rates rose significantly across the yield curve during 2022, elevating interest rate risk (IRR) and the related exposure to earnings and capital. This sharp rise in rates has amplified market risk because a credit union’s assets and liabilities do not reprice equally, potentially impacting net economic values and credit unions’ projected earnings.In September 2022, the NCUA issued Letter to Credit Unions 22-CU-09, Updates to Interest Rate Risk Supervisory Framework, and Supervisory Letter 22-01, Updates to Interest Rate Risk Supervisory Framework, updating the NCUA supervisory framework for IRR.With the April 2022 addition of the Sensitivity to Market Risk, or “S,” component to the CAMELS rating system, the agency has formalized the focus on IRR as a specific rating category separate from liquidity risk.High levels of IRR can increase your credit union’s liquidity risks, contribute to asset quality deterioration and capital erosion, and put pressure on earnings.Well-managed credit unions are prudent and proactive in managing IRR and the related risks to capital, asset quality, earnings, and liquidity. As such, examiners will review your credit union’s IRR program for the following key risk management and control activities:Key assumptions and related data sets are reasonable and well documented.The credit union’s overall level of IRR exposure is properly measured and controlled.Results are communicated to decision-makers and the board of directors.Proactive action is taken to remain within safe and sound policy limits.Additional references for IRR are in the Examiner’s Guide under Workpapers and Resources(opens new window).Liquidity RiskHigher interest rates have caused a slowdown in prepayments for some loans and investment holdings, which has resulted in reduced cashflows. Large increases in share balances from 20202022 may result in an increased level of share sensitivity and share roll off as market rates continue to rise.In evaluating the “L” component of the CAMELS rating to determine the adequacy of your credit union’s liquidity risk management framework, examiners will consider the current and prospective sources of liquidity compared to funding needs. Examiners will review your credit union’s liquidity policies, procedures, and risk limits. Examiners will also evaluate the adequacy of your credit union’s liquidity risk management framework relative to the size, complexity, and risk profile of your credit union.Examiners will assess liquidity management by evaluating:The potential effects of changing interest rates on the market value of assets and borrowing capacity.Scenario analysis for liquidity risk modeling, including possible member share migrations (for example, shifts from core deposits into more rate-sensitive accounts).Scenario analysis for changes in cash flow projections for an appropriate range of relevant factors (for example, changing prepayment speeds).The appropriateness of contingency funding plans to address any plausible unexpected liquidity shortfalls.Resources and guidance on liquidity risk can be found in the NCUA’s Examiner’s Guide.Credit RiskCredit risk is a supervisory priority for 2023 as high inflation and rising interest rates are putting financial pressure on credit union members. High inflation and the increasing likelihood of an increase in unemployment rates could negatively impact borrowers’ ability to repay outstanding debt. Rising interest rates could also result in higher loan payments for borrowers.

Set up a call:

https://calendly.com/cuexamsolutions/talk-to-mark-about-any-exam-topic?month=2024-10

Check out our website:

https://calendly.com/cuexamsolutions/talk-to-mark-about-any-exam-topic?month=2024-10

Are you worried about an NCUA exam in process or looming on the horizon? Don't face it alone!

We're ex-NCUA insiders with decades of experience, ready to guide you to success. Our team understands the intricacies of NCUA examinations from the inside out.

Hire us and gain:

• Peace of mind during your exam process

• Insider knowledge of NCUA procedures and expectations

• Strategies to address potential issues before they become problems

• Continuous access to our extensive subject matter expertise

With our access retainer, you'll have on-demand support from former NCUA experts. We're here to ensure your credit union passers its exam with flying colors in its next examination.

Contact Credit Union Exam Solutions today to learn more about our services and how we can help your credit union succeed.

NCUA's 2023 Priority Letter was recently released. In this episode I discuss the top 3: Interest Rate Risk, Liquidity Risk, and Credit Risk with two members of my team: Todd Miller and Steve Farrar.

Per NCUA:

Supervisory Priorities for 2023

Interest Rate Risk

Interest rates rose significantly across the yield curve during 2022, elevating interest rate risk (IRR) and the related exposure to earnings and capital. This sharp rise in rates has amplified market risk because a credit union’s assets and liabilities do not reprice equally, potentially impacting net economic values and credit unions’ projected earnings.

In September 2022, the NCUA issued Letter to Credit Unions 22-CU-09, Updates to Interest Rate Risk Supervisory Framework, and Supervisory Letter 22-01, Updates to Interest Rate Risk Supervisory Framework, updating the NCUA supervisory framework for IRR.

With the April 2022 addition of the Sensitivity to Market Risk, or “S,” component to the CAMELS rating system, the agency has formalized the focus on IRR as a specific rating category separate from liquidity risk.

High levels of IRR can increase your credit union’s liquidity risks, contribute to asset quality deterioration and capital erosion, and put pressure on earnings.

Well-managed credit unions are prudent and proactive in managing IRR and the related risks to capital, asset quality, earnings, and liquidity. As such, examiners will review your credit union’s IRR program for the following key risk management and control activities:

- Key assumptions and related data sets are reasonable and well documented.

- The credit union’s overall level of IRR exposure is properly measured and controlled.

- Results are communicated to decision-makers and the board of directors.

- Proactive action is taken to remain within safe and sound policy limits.

Additional references for IRR are in the Examiner’s Guide under Workpapers and Resources(opens new window).

Liquidity Risk

Higher interest rates have caused a slowdown in prepayments for some loans and investment holdings, which has resulted in reduced cashflows. Large increases in share balances from 20202022 may result in an increased level of share sensitivity and share roll off as market rates continue to rise.

In evaluating the “L” component of the CAMELS rating to determine the adequacy of your credit union’s liquidity risk management framework, examiners will consider the current and prospective sources of liquidity compared to funding needs. Examiners will review your credit union’s liquidity policies, procedures, and risk limits. Examiners will also evaluate the adequacy of your credit union’s liquidity risk management framework relative to the size, complexity, and risk profile of your credit union.

Examiners will assess liquidity management by evaluating:

- The potential effects of changing interest rates on the market value of assets and borrowing capacity.

- Scenario analysis for liquidity risk modeling, including possible member share migrations (for example, shifts from core deposits into more rate-sensitive accounts).

- Scenario analysis for changes in cash flow projections for an appropriate range of relevant factors (for example, changing prepayment speeds).

- The appropriateness of contingency funding plans to address any plausible unexpected liquidity shortfalls.

Resources and guidance on liquidity risk can be found in the NCUA’s Examiner’s Guide.

Credit Risk

Credit risk is a supervisory priority for 2023 as high inflation and rising interest rates are putting financial pressure on credit union members. High inflation and the increasing likelihood of an increase in unemployment rates could negatively impact borrowers’ ability to repay outstanding debt. Rising interest rates could also result in higher loan payments for borrowers.