My Take on NCUA's Record Retention Regulation Proposal

Download MP3Do you want to maximize

your success with NCUA?

Join Mark Treichel as he shares with

you the insider's view on passing

your exam with Flying Colors.

The With Flying Colors podcast

is sponsored by Credit Union

Exam Solutions by Mark Treichel.

If you would like to work directly

with the Credit Union Exam Solutions

team and receive support to optimize

your results with NCUA so you save time

and money, visit us at marktreichel.

com to find out more.

Hey everyone.

This is mark Treichel with another

episode of, with flying colors.

And today I.

Have a little bit of a different way.

I'm going to be doing this podcast.

And you'll hear about that shortly,

but the NCAA board on April 18th.

Approved a UN.

Advanced notice of proposed

rulemaking on records, retention.

The board action bulletin.

Chairman Harper was stated

as saying is important that

federally insured credit union.

Maintain a robust records

preservation program.

Program whereby vital records

can readily be reconstructed.

Chairman Todd Harper said.

Maintaining all vital records is

central to a credit union's ability

to properly serve its members.

And to the NCUA is ability to

fulfill its supervisory enforcement

and liquidation functions.

Now the board meeting was unique.

In one way in that chairman,

Todd Harper was not at the NCA

building when he did the podcast.

He was on video as a

reminder, they skipped March.

So he wasn't there.

, in April and maybe they're

tiptoeing into doing these remote.

Like they've got most of the

people working remote, but in

any event, That caught my eye.

When I watched the YouTube video.

Because vice chairman, Kyle Houtman

was sitting right next to Tanya Otsuka.

The newest of the three board members.

And it was fitting because this

was a proposed rulemaking that

vice chairman, Kyle Helpmann was

taking a lot of credit for pushing.

He made some great points about the

fact that credit unions don't really

particularly small credit unions.

Don't really understand what

it is they're supposed to keep.

What it is, they're not required to keep.

There was a lot of

reference to the fact that.

Are the attachments guidance.

Or are they not Bidens?

There was a lot of reference to questions

that were being asked as part of the

advanced notice for proposed rule making.

So if you.

R one who likes to comment, take a look

at the questions and get your comments in.

However, they didn't highlight any of

those questions, which I probably will

highlight a few of them here today.

So again this was pushed by Kyle Houtman.

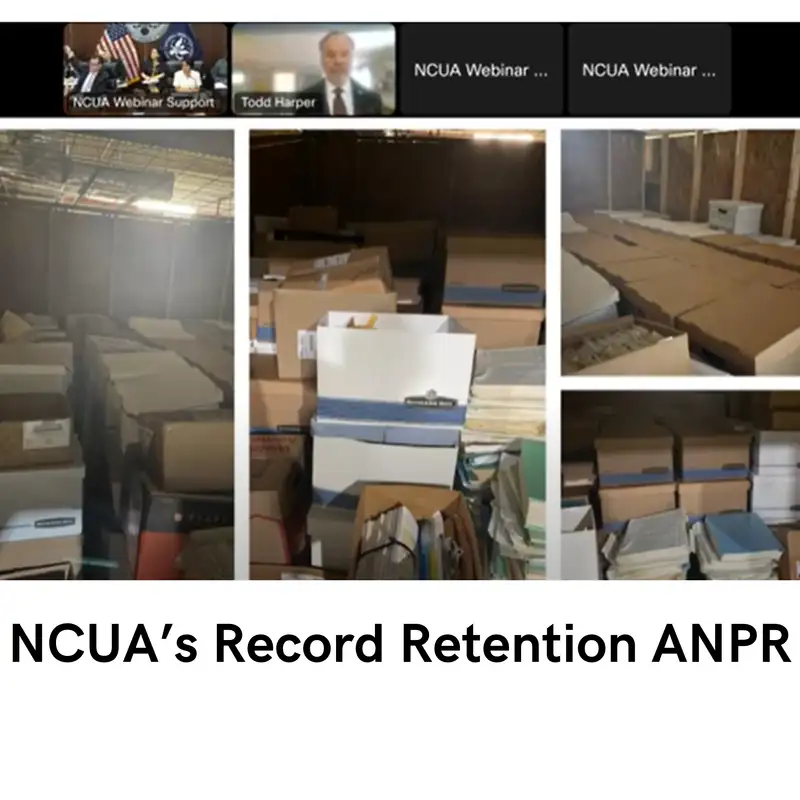

He actually did something very clever.

And he had sent out to some credit

unions, smaller credit unions and

said, show me your storage space,

where you keep your records.

And he talked a lot about,

When he was in the the.

When he worked at.

Stockbrokers how the sec required.

That they keep records seven years and

that there's different rules for the IRS

and that there's different rules for NCUA.

But that people in credit unions, err, on

the side of keeping everything so NC so

that they can't get in trouble with NCUA,

particularly smaller credit unions because

they don't have the time to hire attorneys

to tell them what the rule actually means.

So a lot of good content here.

And he makes a good point

that this is a good proposal.

Should it be come final ever?

For small credit unions and that

their burden is so high at the end.

I'll say why.

That's great.

I agree with it.

But what the other things,

the NCAA board is doing.

Is actually hurting small credit

unions, but I'll save that for the end.

All right.

And as far as particular

questions that they.

Are asking.

They have questions such as.

Does the definition of

vital records in the rule?

Contain all.

And only those records you would consider

to be vital for the credit unions.

. Next question.

Are there additional types of

documents not listed as vital

records that you think should be.

As they are critical for business

operations and to properly serve members.

Next question.

Are there other industry standards

or methodologies outside of the rule

that the agency should consider?

Preserving vital records.

For defining what vital records are and

for determining minimum retention periods.

Next question, the primary focus

of the records, retention guidance

in appendix B relates specifically

to catastrophic act preparedness.

Are there any terms, definitions,

or standards that the board should

consider updating in appendix B?

The next question.

Are there any other changes to

appendix B that you would recommend.

Next question.

How long, and in what format

does your credit union store?

It's vital records.

Next question.

Does your credit union maintain and

store any vital records in a physical

format due to a regulatory requirement

or a supervisory expectation?

Next question, what impact.

Pediments including estimated costs.

Does your credit union encounter

with storing vital records?

Next question.

What records do you deem vital for

business operations that a credit

union should be required to keep

permanently for the purpose of

restoring vital member services.

Next question other than for records,

that must be kept permanently.

Are there specific timeframes

that you would recommend?

That other vital records be retained.

Next questions.

What are the pros and cons of

storing vital records physically

electronically or in other formats,

such as cloud computing storage.

Next question.

Does your credit union rely

on third party vendors to

accurately maintain vital records?

And if so, what are some of the challenges

that these arrangements present?

Next question.

How would you suggest the agency create

a more effective framework for credit

unions to preserve vital records?

Next questions.

What are some challenges for

smaller credit unions defined as

credit unions with less than a

hundred million dollars or less?

In maintaining vital

records and what has worked.

Next and last question.

What additional support training or tech.

Nicola assistance.

Could the NCUA provide if Annie

to assist credit unions with both

understanding and implementing.

Retention requirements.

If any of those questions are

something that you have a strong

opinion on, I highly encourage you.

To comment to the AMPR.

I do believe the NCUA board is

going to take these comments into

consideration and truly would like.

To make this regulation better.

Now there's reference to the appendixes

relating to disaster recovery.

Type situation.

There was reference in the board meeting.

To the federal building.

In Oklahoma that blew up

that did have a credit union.

Headquarters in it.

And I can relate to that.

Reference because when that.

happened, I was a supervisory

examiner in Dallas.

I had peers and friends that were

supervisory examiners in Oklahoma.

They were actually doing exams

down the road from the federal

building when it blew up.

And I was supplementing their exam

teams with some of my examiners.

So when that happened there's a

lot of chaos in the United States.

From the trauma of it, but I have

friends and colleagues who had to

work with the credit union to get

the operations back up and running.

So it's a very important

reg from that perspective.

And kudos to Kyle Hartland

for bringing this up.

He also.

I wanted to touch on this.

If I haven't already, he also.

had credit union sent pictures

of their storage space.

I think I touched on that, but.

I've got a blog where I took a

picture of what was provided and it

it shows exactly why it's an issue.

You've got boxes and boxes.

They're paying for storage.

They don't know what they need.

And NCUA improving the regulation,

I think would go great towards

helping these smaller credit unions.

All right.

And so the new thing I'm doing here

is Discovered some new software.

So I was able to take One's entire

speech at the board meeting and

narrow it down to that and improve

the sound quality a little bit.

And so what's coming up next.

Are the words of vice

chairman, Kyle Hartman.

The advocate for this proposed rule.

And I will have some comments at the end.

To close out this podcast.

That concludes my remarks.

And I now recognize Vice Chairman Hoffman.

Thank you, Mr.

Chairman.

Thank you, Kelly and Matt, for

the presentation and Ghira for

being available for questions.

I want to also thank

Kelly for taking the time.

I would like to look into the impact

of NCOA regulations on records

preservation as they're currently written.

And I definitely want to thank the

leaders of small credit unions, which

I think are the reason we're here.

We had a meeting a few months back,

these small credit unions, they

brought up a few actionable items.

And I believe that meeting and then

our subsequent ones and discussions

with Kelly are why we're here today.

My point is a broader one, that we

actually do listen and there is a point to

talk to us and it can actually have value.

So, I think there are only maybe three

or four credit union leaders on that

call we had, but they're going to wind

up helping thousands of other people.

So, I want to thank those folks.

They did a real job and I want to

thank our staff for that, that meeting,

bringing something to our attention.

Actually, it's going to bring, uh,

real results to a lot of people.

To wit, the crush of regulatory

burden weighs more heavily

on small credit unions.

We cannot talk about financial inclusion

or talk about helping small credit unions

unless we're doing the sort of things

we're doing here today, providing clarity

that frees up scarce resources to focus

on their actual credit union members.

If you go to the extreme, regulatory

burden is often cited as a reason

why otherwise healthy credit unions.

Uh, merge out of existence.

But you know what's worse

than a regulatory burden?

Finding out you're doing things that your

regulator didn't even need you to do.

We found out credit unions were storing

boxes of records from decades ago because

they thought that we at NCUA wanted them.

Now we're aware that other agencies,

et cetera, may require records, but

they said we thought you wanted that.

Some were paying for storage facilities.

And unfortunately, it made sense to do

all of this hoarder like record retention.

Because as long as you get in trouble

for not having a document, and you never

get in any trouble for having extra

documents, the behavior is fairly obvious.

Credit unions and banks talk about

this with suspicious activity

reports, why they file so many.

They never get in trouble.

for filing too many.

They only get in trouble

for not filing one.

Their behavior obviously flows from that.

Uh, yesterday, and I wish you thought

of it earlier, we had the idea to email

two people and ask about their specific,

uh, credit unions records practices.

Um, we got a couple photos at 5.

30 p.

m.

last night.

Slide, please.

Franz, you got a slide?

Yeah, alright.

This is what we got back last night at 5.

30.

Uh, you can see on the right how

deep, this is just one credit

union, which by the way is not

particularly large, I can say it's

under 100 million in assets, okay?

They're paying for this, um, you can

see the yellowed old papers, and so,

if someone says, you know, these days

we have cloud storage, just scan it.

Well, anyone that thinks the answer is

just scan it hasn't had to go through

all those, and even if, You will scan.

Wouldn't it be a pain to find out you

scanned a hundred boxes of documents

and you only had to scan five?

You have to often do it one at a time

for old crinkled documents because

you have to get the whole document.

Otherwise, why are you retaining it?

You can even see if any of

you are old enough to remember

the old dot matrix printers.

You literally can't feed them in

a stack into a modern scanner.

They have those perforated edges

on the side with the holes in it

and you have to pull them off.

I just looked it up.

That's called continuous feed paper.

Um, and so it's not very easy to do.

Um, nobody can argue the

need for keeping records.

It's important.

It's important for NCWay.

It's important for the credit union.

If I was a new credit union CEO, I'd

want them to have good practices.

It's very helpful for new management.

But we, after 15 years, it's time to

re evaluate the unforeseen effects of

Part 749, as it's currently written.

Uh, even if they are maintaining,

um, documents digitally,

do they have to do that?

That costs money too.

Uh, this agency pays for

cloud storage as well.

We get it.

Uh, and I will say that those boxes,

uh, to credit this small guy, It's

piles of old boxes that probably the

people who put the ones in the back

aren't, don't work there anymore.

And I'll say, I had a storage unit.

This is more organized than the one I had.

And, uh, I want to thank a couple people

at NCUA that cleaned out our supply

closets in the hallway on this floor.

I can tell you they were

a lot messier than that.

So even if you have the wherewithal to

digitize, do we actually need to digitize

papers from 1985 because you think NCUA?

If the unintended consequences of a

regulation run counter to what was

intended, a responsible regulator

will re evaluate and adjust.

Many of you know that NCWA annually

reviews one third of its regs

for updates over three years.

That means all of them are addressed.

On many occasions, the NCA has taken

that opportunity to clarify, re

evaluate the impact of the regulations.

Today's action is an example of that.

And although I do want to take credit

for bringing this to the board's

attention, I'll take credit for

that, I want to clarify that I don't

think that the reg was written wrong.

I don't think it was written incorrectly.

I think back then I may well have

written the exact same thing, um,

it's just the result of it and the

incentives that it winds up giving

to any regulated institution.

And one more thing, uh, we talk a lot

about how important it is for small

credit unions to have, uh, well, any

credit union, but particularly small

credit unions to have succession planning.

Well, one way we can help with that as

an agency is make the job more appealing.

Records retention is the example of the

straw that can break the camel's back.

It's one of the many important but

tedious requirements that can make

running a small credit union less

attractive than it could otherwise be.

Thus right sizing the regulatory

burden is one way that NCUA can

make it easier for credit unions to

survive once a long time CEO retires.

The job shouldn't have

to be a labor of love.

NCUA can't control what records

a credit union is required for

their state or other agencies.

But we can reduce unnecessary burden

by ensuring our rules are clear and

do not require more than is needed.

And so the next step here is we're

going to look for ideas from the public

on what should we actually write,

what will actually help that, right?

That's what a credit

union is going to want.

So we can find ideas that reduce

the cost, make it less so people are

digging through old heavy documents.

You probably don't need anything

that uses the dot matrix printer.

But we need to actually publish something.

The good news is, we can probably get

some easy ideas from other agencies.

Just, second slide, Franz, please.

From my Wall Street days, I remember

everything was seven years, okay?

This is from the SEC.

This is kind of what we're looking at.

Seven years records, and then

they say what exactly that means.

Seven years, okay?

I remember anything we wrote,

even in our Bloomberg chats.

With seven years, right?

And you knew that, right?

This is just an example.

Uh, it happens across government.

Um, if you filed your taxes on Monday,

the IRS, just so you know, is, you are

supposed to only have three years worth

of records to back up that 2023 return.

If they audit your 2023

return, they can ask you for

information related to your 2021.

The IRS itself is published.

We're not going to ask

you about 2015, 2021.

Uh, uh, records, okay?

It's, it's the exact same reason.

It's the same reason that in

criminal justice, there's a statute

of limitations for most things.

Because over time, memories fade.

Uh, uh, things get lost.

People die.

Um, and in terms of which year they

can audit, just so you guys know,

uh, Chairman Harper, you're off the

hook from 2017 and earlier to C& L.

Uh, they can only even audit

the last seven years, uh, from

when you filed it, at least.

Okay?

Um, yeah, right.

So thanks again for

the staff working this.

I just have one question, which

is, uh, what I alluded to.

I think credit unions, you know, the

people who sent that photo in are gonna be

like, oh man, I'm glad they're doing this.

What happens next?

They can't, after this meeting, go

and throw out the old stuff just yet.

What is the next?

I can take that question, Vice Chairman.

So, what happens next is really

a question for the board.

Today's action is an advance notice of

proposed rulemaking to solicit feedback

from commenters and stakeholders,

and we expect to get robust feedback

which can then inform any future

action that the board decides to take.

And that could be, well, be a

notice of proposed rulemaking,

but that would be a future action.

Somebody wants to send us

a link, an idea, you know.

Can they do that today?

They can.

Okay.

They can provide feedback all the time,

just as you received feedback prior to.

So, uh, to have an easy idea

that would also serve NCOA's

purposes, we do need records kept.

Um, khautman, ncoa.

gov, um.

But a lot of these things, the notice

comment period, it has an official

start date, it has an official end

date, and the comments are public.

Uh, anyone can email or

call anybody anytime.

But, so if someone today is

hearing about this, they can

send something in today to whom?

They could send comments in to the NCUA

on our website, but specifically in

response to this ANPR, this Uh, document

once the board approves it, it will be

published in the federal register and

we provide specific instructions for

how the public can comment and it's a

transparent process available to all.

But if it is top of mind for anybody

out there who watches this or hears

about it, there's nothing stopping

anybody every time, uh, for, you know,

Calling or emailing say, here's an idea.

Here's what my state regulator does.

You know, something like that.

Uh, if it's top of mind,

that's the time to take action.

I'm pleased that I believe

all three board members are.

Uh, supporting this item and that

I believe all three board members

know how important it is to not make

the life of a small credit union

CEO any harder than it has to be.

And I think the board is all in agreement

that we know that sometimes regulations

can make that less attractive, that

when a little credit union goes away

and that field of membership loses

their own credit union, sometimes

that's because government has made

the job harder than it needs to be.

That concludes my remarks.

Back to Chairman Harper.

Okay.

A lot of good information.

A word for word from Kyle Houtman.

I may do a little bit more

of this in the future.

Let me know if, if you

like this style and, , okay.

So, he made some great points about

how this will help small credit

unions, however, , it's a little bit

of a deck chair on a tech Titanic

type statement because of what the.

Democratic led board is doing right now,

tied to fees, tied to overdrafts, tied to.

, two.

, fees for overdrafts, NSF fees, et cetera.

The fact that NCUA, , is talking

about a concentration risk, , being

a risk tied to fee income.

All of those efforts are

going to increase mergers.

All of those efforts are going

to lead to less credit unions and

ironically create more of a monopoly

type issue situation, in one of his

speeches, chairman Harper talked about.

The fact that two of the three biggest

bay banks don't are don't charge share

overdrafts or checking account overdrafts.

Well guess what, those guys are going to

survive, regardless of whatever happens.

So as.

The government takes an approach that

fees are in and of themselves evil.

It's going to create more mergers

and banks, more murders and credit

unions lead to consolidation

and lead to the point where.

The big banks.

And the big credit unions

are all that's left.

And is that really what's in the

best interest of credit union members

and the United States of America?

I think not.

So again, kudos to Kyle Hartman.

I think perhaps if he had another

Republican vote, He would change

the direction of what's going

on in the fee income arena,

because that is a very partisan.

Topic and I will leave

it at that great job.

Kyle Hartman.

On this particular action and

I hope it leads to a board.

Proposed rule, which will be followed

by a final rule down the road.

So it's going to take a while.

Probably at least another,

it's going to take a while.

Probably at least another

12 months to 18 months.

To get any final traction on this,

but this was a fabulous first step.

All right, this is mark.

Treichel signing off with flying colors.

I hope you'll listen again soon.