NCUA had its November Board meeting with one item. Per the NCUA Board Action Bulletin:ALEXANDRIA, Va. (Nov. 17, 2022) – The National Credit Union Administration Board held its tenth open meeting—and third in person—of 2022. During the meeting, the NCUA’s Chief Financial Officer briefed the NCUA Board on the performance of the National Credit Union Share Insurance Fund for the quarter ending on September 30, 2022.“The Share Insurance Fund performed well in the third quarter,” NCUA Chairman Todd M. Harper said. “The changes in the interest rate environment over the last several months increased the income and earnings of the Fund.”The Share Insurance Fund reported net income of $26.2 million, $20.2 billion in assets, and $73.7 million in total income for the third quarter of 2022. The equity ratio for the Fund remains at 1.26 percent.Per NCUA policy, the equity ratio is updated on a semi-annual basis. The equity ratio as of June 30, 2022, was 1.26 percent, which remained the same from December 2021, and was calculated using an insured share base of $1.69 trillion on June 30, 2022.Additionally, for the third quarter of 2022:The number of composite CAMELS codes 4 and 5 credit unions increased 2.6 percent from the end of the second quarter, to 120 from 117. Assets for these credit unions increased 2.7 percent from the second quarter to $3.8 billion from $3.7 billion.The number of composite CAMELS code 3 credit unions increased 1.7 percent from the end of the second quarter, to 768 from 755. Assets for these credit unions increased 7.6 percent from the second quarter to $47.9 billion from $44.5 billion.“Unfortunately, the Share Insurance Fund report this quarter also shows another side of rising interest rates with an increase in the number of credit unions with a composite CAMELS code 3, 4, or 5 rating,” Chairman Harper said. “Additionally, several credit unions have experienced liquidity issues recently, including some with more than $1 billion in assets. And, with ongoing inflationary pressures and continued interest rate increases likely, the potential for headwinds slowing the economy and increasing stress on households and financial institutions continues to grow.“The NCUA Board will continue to monitor trends and developments in the economy, financial markets, and credit unions. If any issues arise, the Board will also be ready to take action to protect credit union members and the Share Insurance Fund.”At the end of the third quarter of 2022, there were four federally insured credit union failures that cost the Share Insurance Fund $7.0 million in losses.The third-quarter figures are preliminary and unaudited. Additional information on the performance of the Share Insurance Fund is available on NCUA.gov.Access Board Action Memorandums and NCUA rule changes at www.ncua.gov. The NCUA also live streams, archives, and posts videos of open Board meetings online.

Set up a call:

https://calendly.com/cuexamsolutions/talk-to-mark-about-any-exam-topic?month=2024-10

Check out our website:

https://calendly.com/cuexamsolutions/talk-to-mark-about-any-exam-topic?month=2024-10

Are you worried about an NCUA exam in process or looming on the horizon? Don't face it alone!

We're ex-NCUA insiders with decades of experience, ready to guide you to success. Our team understands the intricacies of NCUA examinations from the inside out.

Hire us and gain:

• Peace of mind during your exam process

• Insider knowledge of NCUA procedures and expectations

• Strategies to address potential issues before they become problems

• Continuous access to our extensive subject matter expertise

With our access retainer, you'll have on-demand support from former NCUA experts. We're here to ensure your credit union passers its exam with flying colors in its next examination.

Contact Credit Union Exam Solutions today to learn more about our services and how we can help your credit union succeed.

NCUA had its November Board meeting with one item. Per the NCUA Board Action Bulletin:

ALEXANDRIA, Va. (Nov. 17, 2022) – The National Credit Union Administration Board held its tenth open meeting—and third in person—of 2022. During the meeting, the NCUA’s Chief Financial Officer briefed the NCUA Board on the performance of the National Credit Union Share Insurance Fund for the quarter ending on September 30, 2022.

“The Share Insurance Fund performed well in the third quarter,” NCUA Chairman Todd M. Harper said. “The changes in the interest rate environment over the last several months increased the income and earnings of the Fund.”

The Share Insurance Fund reported net income of $26.2 million, $20.2 billion in assets, and $73.7 million in total income for the third quarter of 2022. The equity ratio for the Fund remains at 1.26 percent.

Per NCUA policy, the equity ratio is updated on a semi-annual basis. The equity ratio as of June 30, 2022, was 1.26 percent, which remained the same from December 2021, and was calculated using an insured share base of $1.69 trillion on June 30, 2022.

Additionally, for the third quarter of 2022:

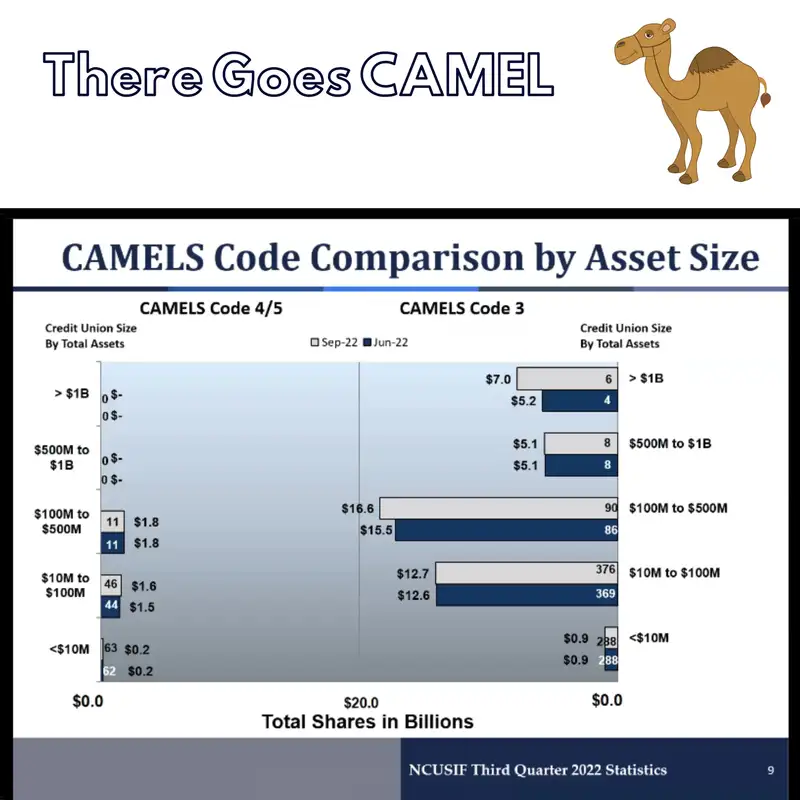

- The number of composite CAMELS codes 4 and 5 credit unions increased 2.6 percent from the end of the second quarter, to 120 from 117. Assets for these credit unions increased 2.7 percent from the second quarter to $3.8 billion from $3.7 billion.

- The number of composite CAMELS code 3 credit unions increased 1.7 percent from the end of the second quarter, to 768 from 755. Assets for these credit unions increased 7.6 percent from the second quarter to $47.9 billion from $44.5 billion.

“Unfortunately, the Share Insurance Fund report this quarter also shows another side of rising interest rates with an increase in the number of credit unions with a composite CAMELS code 3, 4, or 5 rating,” Chairman Harper said. “Additionally, several credit unions have experienced liquidity issues recently, including some with more than $1 billion in assets. And, with ongoing inflationary pressures and continued interest rate increases likely, the potential for headwinds slowing the economy and increasing stress on households and financial institutions continues to grow.

“The NCUA Board will continue to monitor trends and developments in the economy, financial markets, and credit unions. If any issues arise, the Board will also be ready to take action to protect credit union members and the Share Insurance Fund.”

At the end of the third quarter of 2022, there were four federally insured credit union failures that cost the Share Insurance Fund $7.0 million in losses.

The third-quarter figures are preliminary and unaudited. Additional information on the performance of the Share Insurance Fund is available on NCUA.gov.

Access Board Action Memorandums and NCUA rule changes at www.ncua.gov. The NCUA also live streams, archives, and posts videos of open Board meetings online.